Supporting Working Parents thru Growing the Middle Class

As the nature of family and work has evolved in the United States, so should policies that affect the individual taxpayer. Our labor laws and tax system should meet the needs of today’s families.

Father pouring milk into cup for son in his high chair with mother seated at side (H. Armstrong Roberts/Getty Images)

Father pouring milk into cup for son in his high chair with mother seated at side (H. Armstrong Roberts/Getty Images)

To understand the challenges that today’s working parents face, it is helpful to consider the dramatic evolution of work and family over the last 50 years. At the same time, we need to understand the relatively static nature of our labor laws.

Many of our labor policies, such as the Child and Dependent Care Tax Credit and the Earned Income Tax Credit, were created in the 1970s and have changed little since. At that time, women were beginning to work outside the home in increasing numbers. Yet it was more common for women to stay home than participate in the workforce.

Changing nature of work and family

Most households with children were led by married parents, who presumably could divide work and childcare between both spouses. The economy had not yet been exposed to the waves of globalization and technological advances that would challenge the wages of America’s low-skilled workers.

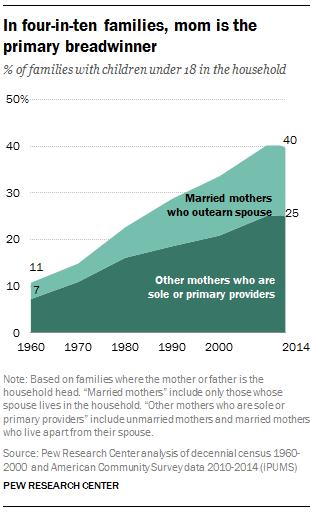

But the nature of family and work has changed dramatically. The share of U.S. households headed by single parents has more than tripled since 1960, with unmarried parents now representing approximately one-third of American households.

The majority of women participate in the labor force and women are now the sole or main breadwinners in 40 percent of American households, according to the Pew Research Center. And wages, especially for workers on the wrong side of the skills curve, have stagnated in recent years.

This has had a number of cascading effects. They include increasing the need for both spouses to work, exacerbating economic pressures for single parents, and discouraging work for some in favor of government benefits.

As a result, the gap between what public policy currently provides and the needs of working parents has widened. Access to affordable and high quality childcare is needed now more than ever, and yet it has become increasingly out of reach for many families.

The gap between what public policy currently provides and the needs of working parents has widened.

Childcare costs increased by 70 percent from 1985 to 2011, in 2011 dollars. For parents living in poverty, childcare costs can consume up to 30 percent (or more) of their monthly income, discouraging mothers in particular from working.

Another issue is the lack of paid parental leave. Only 12 percent of employees have paid leave through their employers, according to the Department of Labor. Lack of paid leave can introduce real financial hardship for families upon the birth or adoption of a child, when leave for work is important for physical healing and bonding yet not always financially viable. The U.S. is alone in the developed world for not having a paid family leave policy.

More generally still, our tax and benefits system introduces high effective marginal tax rates on dual-income households in the form of higher taxes or lost benefits. In a recent Brookings report, Melissa Kearney and Lesley Turner demonstrate how a family headed by a primary earner making $25,000 a year will take home less than 30 percent of a spouse’s earnings because of taxes, benefit phase-outs, and average child care costs. This has the effect of discouraging spousal employment or marriage all together.

Time to modernize labor policies

All of these results suggest it is time to rethink our labor policies and modernize them for the 21st century. The goal should be to create more economic opportunity and provide more choices for families in a fiscally responsible way.

The current political environment bodes well for such a change. The incoming administration has voiced a commitment to family-friendly policies, which complements House Speaker Paul Ryan’s economic opportunity agenda.

Many of the necessary changes involve not creating new policy out of thin air, but restructuring existing programs to make more sense for today’s world. Importantly, these reforms could easily be incorporated (and paid for) by broader tax reform, which is expected to be one of the first legislative actions of the new Congress.

Many of the necessary changes involve not creating new policy out of thin air, but restructuring existing programs to make more sense for today’s world.

Consider child care. A significant portion of working parents are ineligible for child care support under the current system, which directs assistance namely to those below the poverty line and those with a significant income tax liability.

Instead of introducing a new and expensive program, the most straightforward childcare reform would be to make the existing Child and Dependent Care Tax Credit partially refundable, phased out at a lower income threshold, and indexed to child care inflation. Targeting support in this way would help contain costs and direct support to those who need it most, i.e. those for whom child care costs keep them from working.

Or consider the Earned Income Tax Credit (EITC). The EITC functions as a wage subsidy for low-wage workers and has been perhaps the most successful government program for countering low wages and promoting workforce participation.

Policymakers should consider expanding it and improving the delivery options. Currently, the credit is only delivered once a year during tax season. Economists have consistently found that the EITC contributes to better economic outcomes for children and increased parents’ workforce participation.

One study found that the EITC and other tax changes explained up to 60% of the increase in single mothers’ employment between 1984 and 1996. A larger EITC payment would also make it easier to support a family on a single income, including for families who would prefer (but are currently unable) to have one parent as the primary caretaker of their children.

One new program that should be considered is a parental paid leave policy at the federal level. This need not be overly expensive and yet would provide tremendous assistance and support to new parents, for whom going without income for weeks or months is not feasible.

I’ve modeled that a modest paid leave benefit for new mothers would represent approximately 2% of what we currently spend on other programs for employees out of work, meaning unemployment and disability insurance. Even if all new parents received paid leave upon the birth or adoption of a new child, it would be a small fraction of spending and could be paid for by reforms to other programs, such as capping the mortgage interest deduction.

Perhaps the thorniest of the issues is how to restructure our tax and benefit programs more broadly to represent changing family structures, such as dual-income households. Conservatives should seek to reduce high marginal tax rates in our tax and benefit programs, which function as a marriage penalty.

The system could be made more neutral through an expansion of the secondary-earners deduction or through earnings-sharing arrangements. Or Congress could even consider more sweeping reforms, such as moving from a family to an individual tax-and-benefits-based system.

The nature of work and family has changed over the last 50 years, and public policy has yet to keep up. This year offers an opportunity for Washington to change that and improve the lives for working parents across America.

The Catalyst believes that ideas matter. We aim to stimulate debate on the most important issues of the day, featuring a range of arguments that are constructive, high-minded, and share our core values of freedom, opportunity, accountability, and compassion. To that end, we seek out ideas that may challenge us, and the authors’ views presented here are their own; The Catalyst does not endorse any particular policy, politician, or party.

-

Previous Article The Working Class and Globalization An Essay by Rod Dreher, Senior Editor, The American Conservative

-

Next Article Higher Ed: Growing the Middle Class with Modern, Adaptable Skills An Essay by Dr. Eduardo J. Padrón, President of Miami Dade College and Presidential Medal of Freedom winner