The National Debt Worries Americans, but We Are Not Clear About the Solutions

Tackling the issue of the debt means making difficult choices. While Americans support addressing the issue in theory, settling on the best path of compromise and sacrifice is less clear-cut.

Americans have known for decades that the national debt is growing at an unsustainable pace. The accumulation of all our deficits over time has been a concern that ranks high on the list of issues people want our president and Congress to tackle, and deservedly so.

Still, addressing the debt has been a difficult issue around which to galvanize momentum. So far, there’s been no progress by policymakers in Washington, D.C.

How do Americans feel about deficits and debt? According to data from organizations like Gallup and the Peterson Foundation, people have consistently been worried about budget deficits and the national debt for decades. Strong majorities of people think the United States is on the wrong track in managing the national debt.

However, in polling by the Pew Research Center, Americans currently view the issue as important, but less so than in the past decade. When asked to rank their top policy priorities for Congress and the president, the budget deficit has experienced a significant drop in importance in the past several years. The percentage of Americans who say that reducing the budget deficit should be a top policy priority in 2019 was 48 percent, which is a 24-point point drop from the percentage who said that in 2013.

Americans currently view the issue as important, but less so than in the past decade. When asked to rank their top policy priorities for Congress and the president, the budget deficit has experienced a significant drop in importance in the past several years.

That tells us that while Americans are concerned about the debt, other issues are ranking higher on the list of public policy priorities, including increases in percentages of people who are concerned about health care costs and the strength of Medicare. People are also prioritizing the environment, immigration, and climate change more than in prior years at the same time that the budget deficit has moved down the priority list.

With the main drivers of future debt in the United States being mandatory spending programs — Social Security, Medicare, and Medicaid — tackling this issue can mean difficult policy choices, usually some combination of spending cuts and tax increases to change the long-term trajectory of our fiscal future. While Americans are supportive in theory of tackling the debt and understand its importance, there is a real disconnect in terms support for the specific policy solutions to address this challenge.

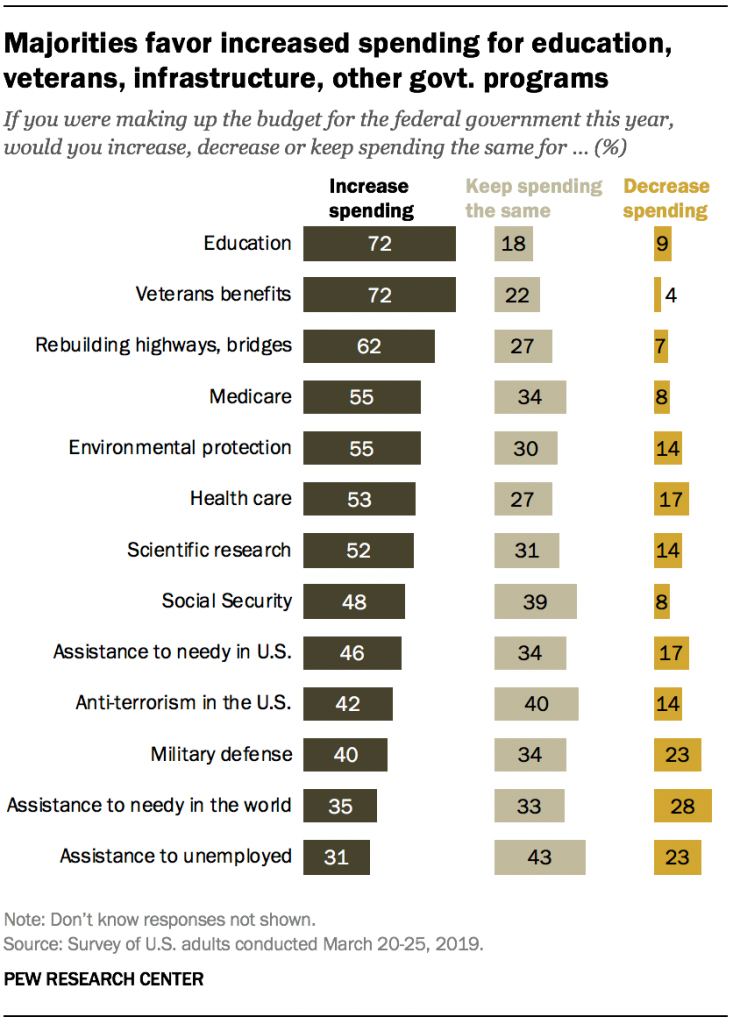

Spending cuts in particular hold no interest to the American public. In polling last year, the Pew Research Center tested 13 different issues areas and asked Americans whether they would support increased spending, decreased spending, or keeping spending about the same across 13 different issue areas, from health care to defense to environmental protection. None of the 13 areas elicited more than 28 percent of the American public who believed funding should be cut. (Only cutting foreign aid reached as high as 28 percent in support.)

While Americans are supportive in theory of tackling the debt and understand its importance, there is a real disconnect in terms support for the specific policy solutions to address this challenge. Spending cuts in particular hold no interest to the American public.

When asked whether they supported smaller government providing fewer services or a bigger government providing more services, results were split down the middle. Equal numbers of people favored each.

The fact that people under 30 are more likely to support a bigger government illustrates one of the real challenges in addressing the debt. Americans don’t seem to be able to square how they would specifically reduce the debt with their overall desire to do so. This dichotomy presents a real conundrum for policymakers.

This is an especially difficult issue to tackle when our younger generations aren’t terribly interested in addressing the debt, at least compared to a front-page topic like climate change. After all, the longer we wait to tackle this issue, the more it will impact younger Americans.

Whenever we get around to tackling the difficult issue of the debt, reforms will likely be phased in over time. That means today’s retiree population is unlikely to face the effect of the policy choices that will likely change Social Security or Medicare, reductions in spending, and tax reforms. Instead, many of the inevitable policies will much more likely affect the under-30 population.

Americans don’t seem to be able to square how they would specifically reduce the debt with their overall desire to do so. This dichotomy presents a real conundrum for policymakers.

All of this is occurring at a time when candidates running for president in the 2020 election are saying little about the national debt and any plans they might have to address it. That is despite the fact that the debt sits at over $23 trillion, the highest it’s ever been.

Any policymaker interested in addressing this issue must demonstrate real political leadership, which translates into a willingness to make tough choices and to convince the American public that there is an urgency to addressing this issue. The battle is indeed uphill, but more important than ever.

The Catalyst believes that ideas matter. We aim to stimulate debate on the most important issues of the day, featuring a range of arguments that are constructive, high-minded, and share our core values of freedom, opportunity, accountability, and compassion. To that end, we seek out ideas that may challenge us, and the authors’ views presented here are their own; The Catalyst does not endorse any particular policy, politician, or party.