A Historical Look at National Debt Teaches an Unambiguous Lesson

Throughout history, leading countries that have chosen ever-rising government spending and debt have undermined their economies as well as their position in the world. The good news for America in the 2020s: History also offers numerous cases of nations that reversed upward debt spirals and laid the foundation for long-term prosperity.

Ruins of the Roman Forum

Ruins of the Roman Forum

The popular claim that America’s exploding national debt doesn’t matter has many disturbing past parallels. Again and again, leading societies have convinced themselves that — quoting the ironic title of a famous book by economists Carmen Reinhart and Kenneth Rogoff — “this time is different,” only to repeat the fate of previous profligate states.

Takeaways from 200 years of history

Reinhart and Rogoff’s review of world history since 1800 shows that economies whose government debt exceeded 90 percent of gross domestic product (GDP) over a prolonged period have realized much slower economic growth than less-indebted countries. And crossing over this threshold has caused economies to slow down relative to their prior experience. (America will reach this level in about 2026.) The Reinhart-Rogoff data sparked predictable controversy, but further studies from the International Monetary Fund and other economists have confirmed their conclusions.

History teaches that high spending on politically-favored priorities and rising debt have consistently undermined growth through three standard mechanisms — crowding out private-sector investment, crowding out public-sector investment in longer-term priorities, and sparking financial crises as investors come to doubt the government’s creditworthiness.

History teaches that high spending on politically-favored priorities and rising debt have consistently undermined growth through three standard mechanisms — crowding out private-sector investment, crowding out public-sector investment in longer-term priorities, and sparking financial crises.

Highly-indebted countries, for instance, have generally experienced relatively high real interest rates, low capital investment, and growing inability to invest in infrastructure and education.

As for financial instability, Reinhart and Rogoff show investors have often suddenly lost confidence in the credibility of a profligate government’s promises. And investors have been right to worry, since government defaults — including in advanced economies — have been surprisingly frequent.

Even in America, numerous 19th century state governments defaulted on debts. While enthusiasts for “Modern Monetary Theory” correctly note that governments printing their own currency need never default, such governments have still caused countless crises through high inflation and other disguised variations on debt repudiation.

Decline and fall of history’s great powers

Today’s debt apologists argue that history’s lessons don’t apply to America because the United States issues the leading reserve currency and remains the world’s preeminent geopolitical power. Evidence from faded great powers of the past, however, tells a more worrisome story.

The Roman Empire, frugal and financially stable during the reign of Augustus, experienced explosive growth in spending on the imperial administration and army during the third century. Emperors resorted to financing themselves through debasement of the coinage, generating massive inflation that weakened agriculture, the middle class, and the credit system — and shredded the Empire’s political stability and external defenses.

Imperial Spain, the leading state in early modern Europe under Charles I and Phillip II, financed unsustainable European military adventures through crushing taxation, money debasement, and vast borrowing from Genoese and German bankers. The result: crowd-out of Castilian industry; decline of urban commercial centers; under-investment in Spain’s waterways and universities; collapse of the monarchy’s credit; recurring financial crises from the late 16th century on; and geopolitical decline after Phillip’s disastrous “Armada” campaign against England.

This pattern repeated itself in 18th century France, where the “Sun King” Louis XIV funded his foreign adventurism and lavish court at Versailles with rising taxes and tremendous borrowing. These policies set back France’s industrialization, destroyed its creditworthiness, and generated acute fiscal crises ending in catastrophic violence and revolution after 1789.

The storming of Bastille in 1789

The storming of Bastille in 1789

China was the world’s leading economy before 1800, but the Qing Dynasty’s increasing expenditures on a sprawling imperial administration led to surging taxes and foreign borrowing in the 19th century. Competing priorities meant China under-invested in canals and irrigation. Iron furnaces that had operated for 800 years closed, and the few modern private-sector firms that came into being failed to take off for lack of capital.

The United Kingdom was the first leading nation to undermine its economy through over-spending on social programs rather than armies and bureaucracy. Starting in the 1920s but particularly after World War II, the British government dramatically boosted spending on public housing, pensions, health care, and other welfare priorities.

The resulting crowd-out meant the country invested less than comparable countries in education, research, infrastructure, and private industry. Living standards fell behind those of most other Western European economies by the 1970s. Meanwhile, economic stagnation weakened the British pound’s position as a leading reserve currency in the 1930s, and ended it in the 1950s.

Under-performance of today’s highly-indebted economies

Debt apologists argue that Japan, whose ratio of gross debt to GDP is above 240 percent, shows that a wealthy country can spend freely and incur large indebtedness without paying any economic price. But Japan’s net indebtedness is far lower, as the government holds an unusually large stock of financial assets. Unlike America, Japan has financed itself almost entirely by domestic borrowing due to the Japanese people’s high savings rates. Japan has also taken decisive steps to curb spending this decade, and its debt/GDP ratio is trending down.

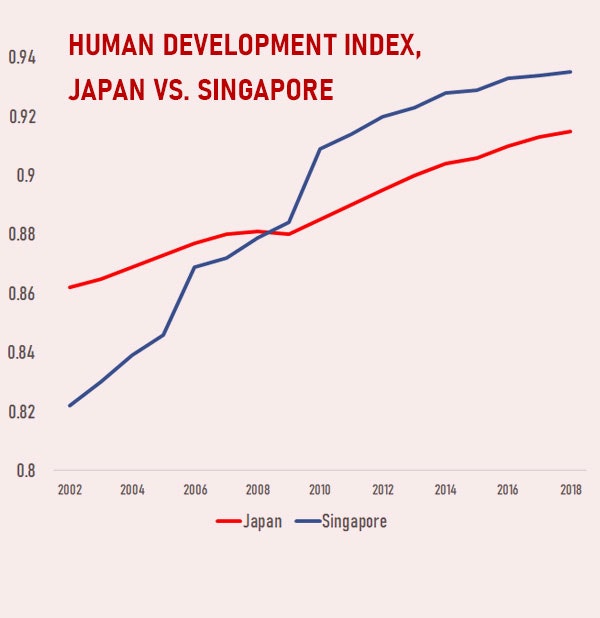

The larger truth about Japan is that its economy has paid a considerable price for its extravagant past spending and borrowing. Investment in education and research has fallen behind other leading economies, while venture capital investment and new business creation have languished. Living standards in more frugal Singapore, Taiwan, and South Korea have either surpassed or will soon surpass Japanese levels.

The Human Development Index from the U.N. Development Programme shows the average achievement in dimensions such as standard of living and health.

The Human Development Index from the U.N. Development Programme shows the average achievement in dimensions such as standard of living and health.

Likewise, Italy achieved extraordinary growth between the 1950s and 1970s but then went on a spending binge and became one of the world’s most indebted countries. Italy’s experience provides further evidence of crowd-out in its educational attainment, business investment, and growth since the 1990s — all among the lowest in Europe.

Success stories show how countries can reverse course

A pessimistic reading of history might suggest poor odds that America can get its house in order. Will America inevitably suffer what historian Niall Ferguson calls a “great degeneration,” in which entrenched interest groups force unending upward ratchets in spending, compromise proves impossible, and political dysfunction leads inexorably to slow growth and national decline?

The good news is that history offers abundant evidence that countries with sound institutions can achieve what economists call “fiscal consolidation” — that is, long-term paths back to sustainable finances. Economist Alberto Alesina has documented numerous examples of fiscal consolidation, many taking place after financial crises. The most durable debt reductions, he finds, have typically resulted from sustained spending restraint rather than tax increases.

The good news is that history offers abundant evidence that countries with sound institutions can achieve what economists call “fiscal consolidation” — that is, long-term paths back to sustainable finances.

Among historical great powers, 18th and 19th century Britain offers the most compelling example of fiscal consolidation. Britain emerged from its failed war in America and its victorious war against Napoleonic France with extraordinary debt levels, but exercised spending restraint and rapidly reduced indebtedness after both conflicts. It then maintained a political consensus for fiscal discipline for 100 years, even thru imperial expansion and growing spending on Victorian Era social programs.

Evidence that fiscal consolidation can succeed in modern democratic societies comes from Sweden, Denmark, and Finland, which experienced severe crises in the early 1990s after two decades of galloping growth in social spending. In each country, parties across the ideological spectrum reached consensus on fiscal prudence and began long processes of thoughtfully reforming their welfare states.

Sweden has reduced its debt/GDP ratio from 70 percent to less than 30 percent, while Denmark has achieved zero net indebtedness, after counting government assets. Fiscal restraint commands 80 percent-plus public support throughout Scandinavia today.

Closer to home, Canada reduced its debt/GDP ratio from 64 percent in 1997 to 31 percent in 2016 – roughly the inverse of America’s move from less than 40 percent in 2008 to 79 percent today. Canada’s achievement also reflects the emergence of a new political consensus after an early 1990s recession. Like Denmark, Canada has experienced faster growth in living standards than America since the late 1990s.

Canada reduced its debt/GDP ratio from 64 percent in 1997 to 31 percent in 2016 – roughly the inverse of America’s move from less than 40 percent in 2008 to 79 percent today. … Canada has experienced faster growth in living standards than America since the late 1990s.

America’s tradition of compromise and restraint

Despite its long history of political contention, America has had one of the world’s best records of fiscal responsibility, until recently. The U.S. government achieved remarkable declines in indebtedness after the Revolutionary War, the Civil War, and the two world wars of the 20th century. From the late 1940s to the 2000s, America’s debt/GDP ratio remained consistently lower than that of most advanced economies, even while America devoted more of its GDP than most to national defense.

In recent decades, America has sustained this track record of discipline in part through a series of political compromises: the Social Security reform of 1983; the Gramm-Rudman Act of 1985; tax laws of 1986 and 1991; the Clinton-Gingrich budget deals of the mid-1990s; and the Obama-Boehner spending deal of 2011. As far as fiscal responsibility is concerned, today’s pattern of partisan intransigence is the exception, not the rule, in modern history.

In recent decades, America has sustained this track record of discipline in part through a series of political compromises … As far as fiscal responsibility is concerned, today’s pattern of partisan intransigence is the exception, not the rule, in modern history.

The lessons of history are clear. Countries that spend and borrow extravagantly do so at their economic and geopolitical peril. But history — including America’s own experience — also teaches that great nations on an unsustainable trajectory can sometimes course-correct. America can, and must, stop the growth in its national debt.

The Catalyst believes that ideas matter. We aim to stimulate debate on the most important issues of the day, featuring a range of arguments that are constructive, high-minded, and share our core values of freedom, opportunity, accountability, and compassion. To that end, we seek out ideas that may challenge us, and the authors’ views presented here are their own; The Catalyst does not endorse any particular policy, politician, or party.

-

Previous Article Why the National Debt Has Yet to Resonate with Students An Essay by Evangeline Mathis, Senior at Southern Methodist University and Catalyst Editorial Intern

-

Next Article The Choice is Ours: The Budget Deficit is a Lack of Prioritization An Essay by Matthew Rooney, Managing Director of the Bush Institute-SMU Economic Growth Initiative